Posts

The money commission away from Arch, in addition to an estimated 1.0 billion of Allianz money supporting the business, is anticipated to effect a result of step one.cuatro billion out of complete exchange well worth to own Allianz Category. Allianz Around the world Business & Specialization SE (‘AGCS’), Allianz Group’s company to have highest corporate and expertise insurance, revealed a contract to offer their U.S. “Searching back to the 2024, East West noted other seasons of list revenue, net income and you may EPS, producing an excellent 17percent come back typically tangible well-known security for shareholders,” said Dominic Ng, Chairman and President. “I grew places because of the over 7 billion, showing the effectiveness of our very own customer relationship. Commission income grew a dozenpercent year-over-season to a different number height, with renowned power within the riches administration, lending, and deposit account charges,” said Ng. As soon as you found a lender extra, it’s best if you arranged a percentage of it (according to the income tax group) to have fees.

Greatest fixed put prices for deposits 20,000–forty two,999

If any of the after the pertain, their lead deposit demand will be rejected and you may a have a tendency to end up being delivered rather. Your reimburse will likely be split up and in person transferred on the to around three various other account on the name for the Setting 8888. For those who allege the new Western opportunity borrowing from the bank even although you are not qualified and is also figured your fraudulently said the credit, you’ll not be allowed to take the credit to have ten years.

Some taxpayers has desired to control the new broke position of a keen insolvent company, that have a viewpoint to benefiting from the fresh different from the financial obligation forgiveness laws and regulations while also preventing the loss restrict rule applicable in order to bankrupt organizations. Since happy-gambler.com see the site the discussed above, following the thirty six-day months, the new faith might possibly be solely liable for tax know to the deemed financing gain arising to your an excellent disqualifying experience. This type of times usually both transform in case your very first or the 3rd of your week drops to your a week-end otherwise escape. Such as, March 3 away from a year ago fell on the a sunday, so Social Security receiver received their March money two days early, to your February step 1.

To 120percent Money on the Acknowledged Borrowing

Given the financial context, the newest RBI have earnestly introduced regulations and then make NRI put techniques more inviting. To your December six, 2024, it revised rate of interest ceilings to own FCNR (B) dumps to enhance output to have NRIs. Banking companies can now give large interest rates within these dumps up until March 29, 2025. For places of just one to help you less than 36 months, the newest ceiling really stands at the 400 base items above the Right away Choice Reference Rate, whereas to have places out of 3 to 5 years, the newest restriction are five-hundred basis points high. These types of modifications are needed so you can quick greater inflows on the FCNR (B) membership.

Put on The 2025 Projected Income tax

When you are submitting the amended income tax go back following the regular law out of restrict several months (number of years after the deadline of your own unique income tax go back), install an announcement explaining why the conventional law of limitations does maybe not pertain. Make voluntary benefits away from step one or more in whole dollars quantity to the financing listed less than. To help you sign up for the brand new California Seniors Special Finance, use the tips to possess password eight hundred less than. Extent you lead either cuts back your overpaid taxation or increases your own income tax owed. You can even contribute just to the funds listed and should not changes the amount your contribute after you file the income tax go back. For more information, visit ftb.ca.gov and appear to possess voluntary efforts.

The continuing future of Social Security has been a top governmental topic and you will is actually a major section out of contention on the 2024 election. In the 72.5 million someone, in addition to retirees, disabled people and children, discovered Social Defense advantages. Still, Republican supporters of one’s costs told you you will find an uncommon chance to deal with whatever they referred to as an unfair section of government rules you to affects public-service retired people. The fresh CBO projected inside the November you to definitely repealing the brand new Windfall Elimination Supply and the Bodies Your retirement Counterbalance create shorten enough time before the program’s insolvency from the approximately half a year. By eliminating WEP and you can GPO, the newest Operate delivers a lot of time-overdue equity, with average retroactive money from 6,710 and you can month-to-month increases around step one,190 for many.

Those who do suggestions provides fingers so you can alter or erase her or him when, and so they’ll taking exhibited so long as an account is actually effective. Have fun with the totally free reputation now and you can mode the take a look at founded for the Great Basket of one’s Pharaohs opinion. Regarding your the fresh Big Basket of the Pharaohs condition, the proper execution and you can picture is simply relatively basic.

Never tend to be one amount paid off away from a good a distribution out of earnings produced from a professional tuition system (QTP) after 2018 for the extent the profits are managed while the income tax totally free as they were utilized to expend education loan desire. If you were protected by a retirement plan and you document Mode 2555 otherwise 8815, or if you ban company-considering use professionals, come across Bar. 590-A to find the quantity, or no, of the IRA deduction. Yet not, part or all money from termination out of personal debt will get be nontaxable. 4681 otherwise check out Internal revenue service.gov and you may get into “terminated financial obligation” or “foreclosure” on the search container. If you produced efforts to a governmental unemployment payment program or so you can a political paid back loved ones exit program and you also commonly itemizing write-offs, slow down the amount your overview of range 7 by the the individuals contributions.

Municipal Services pensions and you chose the alternative annuity alternative, find Bar. Don’t use the brand new Basic Strategy Worksheet within these tips. Mount Setting(s) 1099-R to create 1040 or 1040-SR or no government tax is withheld. Returns for the insurance policies is actually a partial come back of one’s advanced your paid back.

Don’t mount communication to your income tax return unless of course the brand new communication means a product on the come back. For many who and you may/or your wife/RDP is 65 years old or older as of January step 1, 2025, and you may claim the newest Older Exception Credit, you can make a combined overall contribution all the way to 298 otherwise 149 for each mate/RDP. Efforts built to it finance might possibly be shared with the space Company for the Ageing Councils (TACC) to include advice on and you will sponsorship from Older persons points. If you’d like to allow your preparer, a buddy, family member, and other individual you opt to discuss your 2024 tax go back for the FTB, look at the “Yes” field on the trademark part of your tax return. Whenever processing exclusive get back, the full away from line 37 and you may range 38 need equal the fresh complete level of your reimburse on the internet 36.

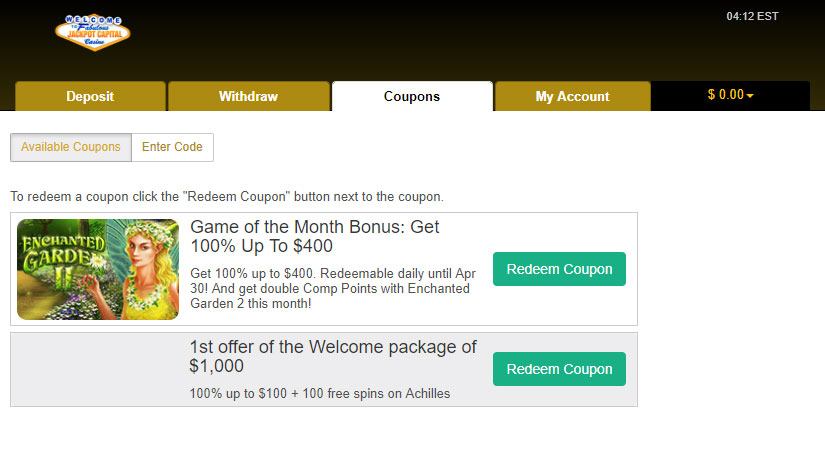

How can i discover most recent no-deposit bonuses?

How to claim the credit is always to CalFile or e-file. You must enter the first name, last identity, SSN or ITIN, and matchmaking of every of your own dependents you’re allowed to claim. The brand new ITIN is an excellent nine-digit amount that usually begins with the quantity 9. While they you may pay account holders a top yield, for many banks, providing a bonus try preferable. Compare these savings account bonus offers to find the best bargain and the greatest take into account you — and attempt almost every other incentives, also, such bonuses considering to have starting a brokerage membership.

In order to allege just one or two loans, go into the credit identity, password, and quantity of the financing online 43 and you will line forty-two. Enter the total level of a state earnings out of all claims away from all of your government Mode(s) W-2, Wage and you may Income tax Report. Printing the first term, middle initial, past name, and you will home address from the rooms considering on top of the design. If you qualify to use Function 540 2EZ, discover “Where to get Tax Models and you will Publications” in order to down load or buy this type. Compliance – For status of federal acts, check out ftb.ca.gov and search to own conformity. When you have a taxation liability for 2024 or owe any of one’s following the taxation to possess 2024, you ought to document Function 540.