Content

- If you are settled in the uk plus don’t has a file to show their straight to stay static in the united kingdom

- If you have ‘compensated condition’ underneath the European union Payment Plan

- The newest term verification standards while the authorities force to stop economic offense

- Checking Your own Immigration Status

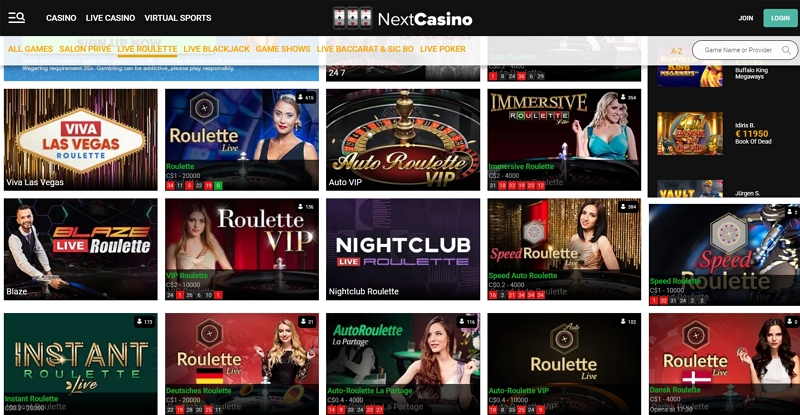

Finish the attached setting to apply for a region resident membership by the post. Gabi is actually a material writer who’s passionate about carrying out blogs one motivates. The woman functions background is founded on https://casinolead.ca/jackpot-city-casino/ writing persuasive web site content, now offering expert services in the tool product sales backup. Gabi’s top priority whenever composing content is ensuring that the language generate an impact on the readers. There are the girl making complex company finance and you will accounting subjects simple to know to have entrepreneurs and small businesses.

If you are settled in the uk plus don’t has a file to show their straight to stay static in the united kingdom

To decide whether you’re tax resident in britain, a legal household try (SRT) are brought inside the 2013. Let’s think for a moment which you’ve been way of life beyond your British for quite some time, however, a different occupation possibility takes you returning to your homeland. With this particular extreme move, the domestic status you are going to key out of ‘non-resident’ to help you ‘resident’.

If you have ‘compensated condition’ underneath the European union Payment Plan

An enthusiastic eVisa try an on-line listing of one’s immigration position and the brand new standards of your own sort of consent you have got to go into or stay in great britain. That is of use if you would like prove your citizenship unconditionally, for example trying to get a great passport otherwise work. Immigration condition refers to the legal condition away from men’s straight to stay-in the united kingdom. It can be categorized to the multiple classes, along with Long Log off to remain (ILR), Limited Hop out to keep, Proper away from Abode, and others.

- For many who don’t keep them, you will possibly not be able to panel the trip so you can Canada.

- They give a handy and easy-to-fool around with system to possess handling funds.

- We can not provide immigration suggestions about personal software after you get in touch with united states.

- Brief low-residence suppresses people from artificially organizing their issues to stop United kingdom taxation by the temporarily as low-citizen.

Because you browse the new automatic to another country tests, it’s imperative to consider how double income tax arrangements between the United kingdom or any other places might affect you. The fresh Statutory Residence Attempt Uk functions as the an excellent around three-step test in order to truthfully influence your United kingdom income tax residency status and you can understand their tax debt. Understanding the income tax house position is important, as it tend to dictate the amount of money and you will gains you need to are accountable to HM Cash and you can Culture (HMRC). You ought to tell us on the one transform for the personal details, such as your term and you will nationality. You should also write to us if any of one’s advice shown on your own on the internet immigration reputation character is incorrect.

The nation link enforce on condition that you’ve been classified while the a great United kingdom resident for around one of many before about three taxation decades. If you satisfy these automated Uk screening, you are classified while the a good British citizen for that taxation year. Should your software program is winning, everything you’ll want to do depends upon how you turned-out their identity.

For more information, and for which you might possibly be offered an actual physical document to prove your status, go to the ‘once you’ve applied’ chapter of one’s Eu Payment System guidance. Concerns along with are present, including in what qualifies as the a great ‘home’ and also the translation away from ‘exceptional circumstances’ whenever depending times of visibility in the united kingdom. You might be able to sign up for indefinite hop out to keep (ILR) immediately after an appartment period of time residing great britain. Opting for a certain Uk bank is dictate the skill of non-owners to build a credit rating in the uk. When you’re credit rating does not transfer when swinging abroad, the duty for a fantastic costs remains.

- For individuals who’lso are a keen Eu, EEA, otherwise Swiss resident, you could potentially apply for settled or pre-paid reputation underneath the Eu Settlement Plan.

- The brand new taxation-100 percent free private allocation can be acquired to low-resident British Owners.

- In order to be eligible for the brand new household nil-price ring, multiple criteria must be fulfilled.

- If you need help with their British tax criteria, whether linked to possessions, or other possessions, you need to search professional advice of a reliable United kingdom income tax professional.

- The first is that it is used up against a house the fresh individual had, or got a portion in the, at some point ahead of the demise and you will was applied because their main house.

British Visas and you can Immigration (UKVI) is development a digital immigration program. It indicates our company is replacing actual data having an online list of your own immigration reputation. Unless you have check in information, you’ll have the ability to perform them. See how to score a certificate out of residence since the an enthusiastic individual, team otherwise organization which means you don’t get taxed twice for the international money.

The newest term verification standards while the authorities force to stop economic offense

If perhaps you were offered consent in which to stay the united kingdom on the otherwise prior to 31 October 2024 but do not provides a legitimate identity document, for example a passport otherwise an excellent BRP, you may make a UKVI membership and availability the eVisa. For those who’ve immigrated to the British, or you’lso are a global citizen which have connections to the Uk, your taxation situation may possibly not be clear-cut. Expertise United kingdom income tax residency legislation is essential to possess choosing whenever and you can the manner in which you are obligated to pay income tax and for wealth thought in the years ahead. While the residential position individually impacts the tax debt since the an expat, failing to report changes or maintaining expected facts can lead to problems with the fresh HM Money & Culture (HMRC). All the details offered will allow you to stay on greatest of your reporting standards and steer clear of prospective pitfalls linked to the taxation personal debt in britain. Yet not, should your status transform—state, you feel an excellent Uk citizen after life style abroad—you should share with HMRC.

Great britain bodies needs to be informed concerning your residential reputation, specially when you’re an excellent All of us resident. This short article performs a vital role within the deciding their income tax financial obligation. In the united kingdom tax globe, your domicile status requires top honors regarding the newest income tax away from overseas earnings.

Checking Your own Immigration Status

Prior mainline online game provides leaned to the cooperative multiplayer, specifically Citizen Worst 5 and you will Resident Worst 6, however these is actually commonly considered to be one of many worst of the fresh numbered records. RNRB is also forgotten if your requirements are not met – such, if your property is maybe not passed away to lead descendants, should your inactive never had the house or if the property happened inside the a good discretionary believe. If a house is worth more 2m, the fresh income tax-totally free allotment actually starts to taper away from at a rate out of step 1 per 2 an excessive amount of value. As a result an individual is eligible to an individual RNRB, the fresh rescue are missing while the property value the new property exceeds dos.35m, considering Ms Mutton. Right here, Telegraph Currency shows you how household nil-rate ring works to help you make more of your allowance. The fresh house nil-rate band was initially delivered inside April 2017 and you will relates to estates when a dying taken place to your otherwise just after April , and the chief residence might have been remaining in order to direct descendants.

If you have two Uk property, work at the test for each but only one of those need meet with the criteria. The new deeming code captures days someone provides invested in the united kingdom but provides leftover just before midnight. Non-exceptional issues try considered life incidents, for example beginning, relationship, divorce, visiting the uk for medical treatment or lost a trip or ferry due to delays otherwise termination. Accumulated for those who invested pretty much than 183 days in the united kingdom songs easy adequate but visiting a proper number is tricky. You could potentially inquire about advice about carrying out a UKVI account and you can delivering entry to an eVisa. You are told tips availability their eVisa on the decision email address or page.

A straightforward example might possibly be that if you save money than just 183 months in the united kingdom inside a tax seasons, you’lso are likely to be a great British resident. However,, as with every anything income tax-related, it can score a little more cutting-edge than simply one to. Regarding the simplest conditions, the residential reputation in the united kingdom are, better, exactly that—it’s all about if or not you phone call the uk house to own taxation intentions. The residential position decides how the Uk’s HM Cash & Society (HMRC)—that’s british sort of the fresh taxman—would be knocking on your own doorway, asking for taxation on the around the world income. As the April 6th 2015 expats and you will low-people offering a great Uk possessions are obligated to pay investment development taxation for the people progress generated. Once you have use of your eVisa, you could register for the UKVI account to access your own eVisa and you will prove your immigration condition.