Content

Most other government companies and serve as the main government managers of commercial banking companies; any office of the Comptroller of your Money supervises national banks, and the Federal Deposit Insurance coverage Company supervises state banking institutions which might be perhaps not people in the fresh Government Reserve System. As of December 31, 2022, the previous Trademark Bank had overall deposits from $88.six billion and you will total assets from $110.cuatro billion. Your order having Flagstar Bank, N.A., included the purchase around $38.4 billion of Signature Link Lender’s assets, and finance of $twelve.9 billion bought at a savings of $dos.7 billion. As much as $60 billion inside financing will remain from the receivership for later temper by the FDIC. As well, the new FDIC gotten security appreciate liberties in the Nyc Area Bancorp, Inc., popular stock that have a possible property value to $300 million.

Raging, Petulant, Contradictory: Simple tips to Interpret Trump’s Middle eastern countries February Madness

Extra short-term rate of interest increases, along with extended advantage maturities can get continue to improve unrealized loss for the ties and you will affect lender harmony sheets in the coming home. A great number of the uninsured depositors from the SVB and you may Signature Lender were small and medium-size of enterprises. Consequently, there had been issues you to losings to these depositors manage put them at risk of being unable to create payroll and you will shell out suppliers. Furthermore, for the liquidity away from banking organizations then smaller in addition to their financing costs enhanced, financial organizations becomes much less prepared to give to help you organizations and you can houses. This type of consequences create sign up for weaker economic overall performance, next destroy monetary locations, and have most other issue negative effects. Including Silvergate Bank, Trademark Bank had and concentrated a significant part of its business model on the digital advantage world.

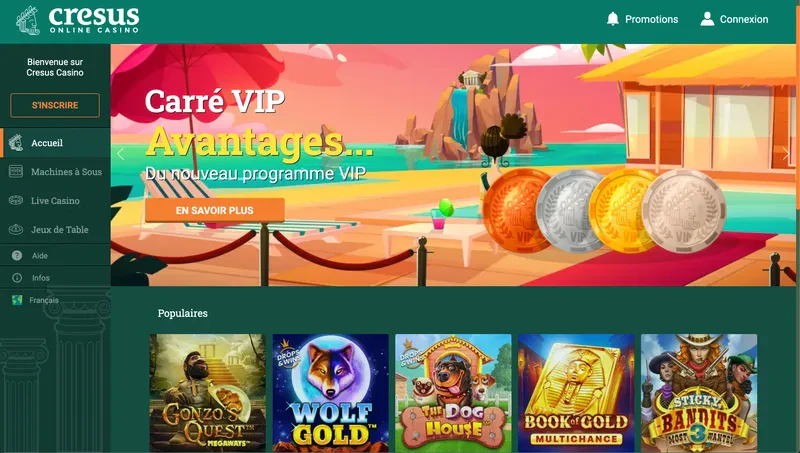

- Whereas, to find no deposit extra rules for the internet casino web sites which have publicly offered now offers, you need to look at the extra breakdown on the website.

- The deal aids Saudi Arabia’s Eyes 2030 — a financial diversification method intended for cutting reliance upon oil revenues from the expanding low-oils exports and you may strengthening regional exchange alliances, and that have Egypt.

- The new Set-aside Banks’ merchandising services tend to be submitting money and you may coin, meeting inspections, digitally animated money as a result of FedACH (the fresh Federal Reserve’s automated clearing house system), and while it began with 2023, assisting instantaneous repayments by using the FedNow solution.

- Processing times reflect the time period from the time the field tasks are complete in order to if the declaration from test is sent on the lender (or User Financial Protection Bureau (CFPB)/State Lender Company).

USF Contribution Grounds Dips To 32.8 Percent For Next One-fourth Away from 2024

Which memorandum surveys U.S. financial sanctions and you will anti-currency laundering (AML) advancements inside 2024 and offers a perspective for 2025. Saudi Arabia’s Ministry out of Financing granted 789 licenses in order to Egyptian enterprises inside the another quarter from 2024 — a great 71 % increase in the exact same several months within the 2023 — deciding to make the country the top receiver of your it allows regarding the Kingdom. The new arrangement is part of a series of financial selling finalized during the Saudi Top Prince Mohammed container Salman’s October visit to the newest North African nation, that also dependent the brand new Saudi-Egyptian Best Coordination Council. This was primarily determined by distribution of its 34.52 percent risk within the Almarai so you can shareholders, causing an online gain of SR11.3 billion.

Undoubtedly, all types of gambling establishment bonuses have issues, and no deposit of them. Giving an intensive evaluation, we’ve weighed the pros and drawbacks away from no deposit bonuses inside Canada. Such financial institutions is actually large enough to possess customers with large deposits but nonetheless small enough which they was allowed to fail. You will find a noticeable escalation in the speed away from growth of such dumps doing just after 2018, a posture that’s likely due to the fresh judge transform explained more than. More striking, although not, is the 20% rise in 2023 to own banking institutions having property between $step one billion and you can $one hundred billion.

A longer time out of eligibility are an exemption, but there is cases whenever these types of bonuses is actually appropriate to own as much as 7 otherwise thirty day period bons-casino.net/en visit this web-site . Generally, immediately after registering a free account, a no deposit render might possibly be designed for 7 days. Some of these also provides may be appropriate indefinitely, despite you have registered.

The brand new casino are an integral part of the newest Gambling establishment Perks Category, meaning you can use one respect things collected at this site to your any other CR brand name webpages. “Given everything we’ve present in the last six months, all banks had been obligated to improve deposit prices to stay aggressive,” Curotto advised Observer, talking about the brand new Federal Put aside’s persisted interest rate nature hikes while the just last year. The newest challenging need for Apple’s the new banking device really stands inside stark examine so you can customers’ waning trust in the new You.S. bank operating system in the midst of the fresh constant disorder out of regional banking companies. Professionals state Apple’s success comes from both the solid brand sense and a smart union having a professional bank from the proper day. To the Saturday the newest Supreme Courtroom dismissed the fresh attention by business person Adi Keizman from the decision of one’s section legal obligating your to pay six million shekels ($step 1.six million) to help you artwork broker and you will websites entrepreneur Muly Litvak. The new Panel from Directors from CIBC reviewed which news release past to they being awarded.

No deposit Incentive of one’s Day: Updated February 2025

Trump’s court group often inquire the new Ultimate Court to provide a stay on demo proceedings up until it things a great ruling for the obstruction thing, and this ruling you may been because the later as the last week away from Summer in the event the Ultimate Court’s term wraps. By taking upwards a destination because of the accused Jan. 6 Capitol rioter Joseph W. Fischer, the newest judge you are going to undo by far the most significant government unlawful charge Trump is actually facing to possess their attempt to subvert democracy. Unique guidance Jack Smith’s work to hold Donald Trump completely responsible for seeking overturn the outcomes of the 2020 presidential election are facing a brand new challenge — the due to a-one-line acquisition regarding the Ultimate Legal.

Donald Trump’s chaotic strategy features leftover inventory locations tumbling and you may produced loads of anxiety among opportunities you to believe change to the You. Which content has aided 1000s of someone end carrying for a realtor. Yet not, over six,100 people every day still like to waiting to speak to a realtor concerning the Work. Such calls, as well as folks and you can visits within the local organizations, continues to boost along the future days and you may months. If one has received the superior subtracted from their CSRS annuity, and applies to possess Societal Security benefits, SSA will tell the person you to definitely their advanced tend to today become deducted off their month-to-month Personal Defense pros. If your individual prepaid service its advanced on the Locations to have Medicare & Medicaid Functions, and you can SSA tells him or her one to the advanced have a tendency to today become subtracted using their monthly Societal Protection advantages, they’ll get any appropriate reimburse.

Conclusion In the six Focus Slot

Because the in the past noted, the’s unrealized loss for the ties had been $620 billion as of December 30, 2022, and you can flames conversion process inspired from the deposit outflows might have next depressed cost and you may dysfunctional collateral. A familiar thread between your failure from Silvergate Lender and also the failure of SVB try the fresh accumulation from losings from the banks’ ties profiles. On the wake of the pandemic, because the rates of interest stayed during the close-zero, of a lot associations replied from the “interacting with to have yield” due to investment within the extended-name possessions, while others reduced to the-balance sheet exchangeability – bucks, government money–to improve total output to your making possessions and keep net interest margins. Such conclusion triggered a second well-known motif in the this type of organizations – heightened contact with desire-rate exposure, which place inactive while the unrealized losses for many banking companies since the costs quickly rose over the past year. When Silvergate Lender and SVB experienced quickly increasing exchangeability demands, they ended up selling ties at a loss. The brand new now know losings composed both liquidity and you will financing risk for those companies, ultimately causing a home-liquidation and you may incapacity.

This is basically the interest rate you to banking companies costs one another to own immediately financing from government fund, which are the supplies stored because of the banks in the Fed. Which rate is actually influenced by the marketplace which is maybe not clearly mandated by Given. The newest Provided hence tries to fall into line the brand new active government fund rate for the targeted price, primarily because of the modifying the IORB speed.92 The brand new Government Set-aside System always adjusts the new federal fund rates target by the 0.25% otherwise 0.50% at a time.

My personal Account

Given the will set you back inside, the only real reasoning to utilize mutual deposits would be to effortlessly increase covered deposits. The brand new line called “p50” shows the newest carrying of uninsured dumps of one’s average financial inside the for every dimensions group. A lot more generally, the newest economic climate will continue to deal with tall disadvantage risks regarding the negative effects of rising prices, rising industry rates, and ongoing geopolitical concerns. Borrowing from the bank top quality and you can profitability will get deteriorate because of such threats, probably resulting in tighter loan underwriting, slower financing growth, highest provision expenses, and you may exchangeability restrictions.